S&P500

The US stock market comes to a halt ahead of the US nonfarm payrolls

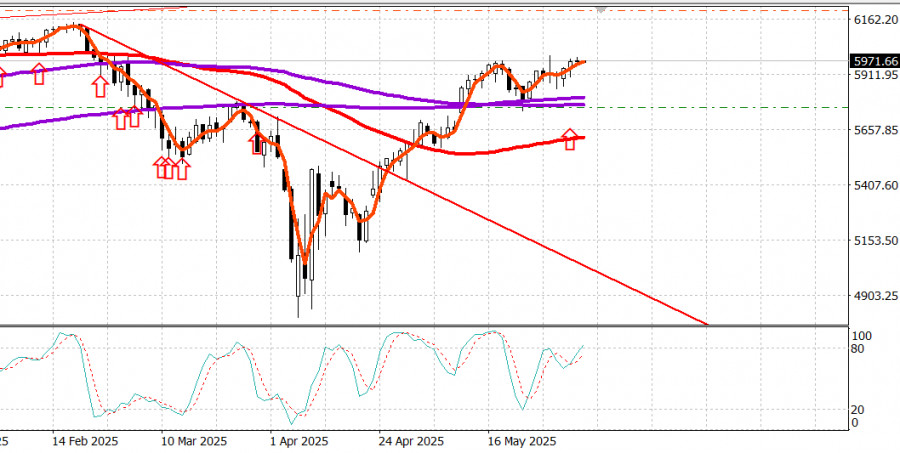

Snapshot of major US indices on Wednesday: Dow -0.2%, NASDAQ +0.3%, S&P 500 flat at 5970, trading within a range of 5400–6200.

The stock market was lively but didn't take off during a session clouded due to some disappointing economic data and President Trump's remark that President Xi is "a very tough man and extremely difficult to make deals with."

There was no further context to Trump's statement, though rumors had circulated that the two leaders might speak on Friday. Still, the comment was enough to raise doubts about the state of US-China relations and the future of their respective tariffs and trade restrictions. Media reports noted that China continues to strictly limit the supply of rare earth metals to the market—already impacting major automakers, particularly in Europe.

For the most part, the market drifted in a sluggish session that lacked conviction from both buyers and sellers.

Nonetheless, cap-weighted indices managed to hold their ground thanks to relative strength in mega-cap stocks, particularly Meta Platforms (META 687.95, +21.10, +3.2%), Amazon.com (AMZN 207.23, +1.52, +0.7%), and NVIDIA (NVDA 141.92, +0.70, +0.5%). Their gains helped offset weakness in CrowdStrike (CRWD 460.56, -28.20, -5.8%) following a revenue miss and disappointing guidance, and Apple (AAPL 202.82, -0.45, -0.2%), which saw its rating downgraded to "Hold."

Once again, semiconductor stocks stood out from the crowd, as evidenced by a 1.4% gain in the Philadelphia Semiconductor Index. They were the exception in an indecisive market that also wrestled with growth concerns sparked by core economic reports.

The May ADP Employment Change report showed that private payrolls grew by just 37,000 jobs (consensus: 115,000), with no new jobs in small businesses, which actually lost 13,000 jobs. This report was released at 8:15 a.m. ET, followed by the May ISM Services PMI at 10:00 a.m. ET, which came in at a contractionary 49.9%—only the fourth sub-50 reading in the past 60 months.

Treasury yields declined after both reports. The 2-year yield, at 3.96% just before the ADP release, fell to 3.88%—an 8-basis-point drop. The 10-year yield declined from 4.46% to 4.36%, down 10 basis points.

The US dollar also traded lower alongside Treasury yields, but falling rates weren't enough to inspire stocks, which paused in a consolidative session.

As of today, the S&P 500 has risen 23.5% from its April 7 low and is trading at 21.6x forward 12-month earnings, a 17% premium to its 10-year average, according to FactSet.

The Communication Services sector (+1.4%) led all sectors and was the only one to gain at least 1.0%. The next best performers were Materials (+0.3%) and Real Estate (+0.3%). The biggest losers were Energy (-1.9%) and Utilities (-1.7%).

Year-to-date performance:

- S&P 500: +1.5%

- Nasdaq: +0.8%

- DJIA: -0.3%

- S&P 400: -3.1%

- Russell 2000: -5.9%

Economic calendar on Wednesday

ISM Services PMI dropped to 49.9% in May (consensus: 52.0%) from 51.6% in April. The 50.0% threshold marks the boundary between expansion and contraction, so the May reading reflects a shift from growth to contraction in the services sector.

This is only the fourth time in the last 60 months the index has fallen below 50.0%. The key takeaway is that the report signals a troubling mix of slowing growth in the largest part of the economy and continued price pressures—potentially interpreted as stagflation (despite the employment component returning to expansion). In any case, the main message is that growth has slowed amid ongoing tariff uncertainty.

ADP Employment Report showed private payrolls increased by 37,000 in May (consensus: 115,000) following a downwardly revised 60,000 in April (from 62,000). The goods-producing sector shed 2,000 jobs, while the service-providing sector added 36,000. Mid-sized firms added 49,000 jobs, small businesses lost 13,000, and large businesses lost 3,000.

S&P Global US Services PMI rose to 53.7 from 50.8 previously.

MBA mortgage applications index declined by 3.9% for the week, with refinance applications down 4% and purchase applications also down 4%.

Energy market Brent crude is trading at $64.90. Oil prices are struggling to stay near $65 despite rising OPEC output.

Conclusion The stock market is holding onto its gains, but economic headwinds are increasingly pushing back.