Here is a step-by-step guide on how to create a Bitcoin wallet. Learn about different types of wallets, the necessary steps for setting one up, and tips to keep your funds safe. Without a crypto wallet, it’s impossible to perform any operation with digital currencies, whether sending or receiving. That’s why in this article, we’ll briefly cover the types of storage available, how to create a Bitcoin wallet, and how to use it.

A crypto wallet is essential for any transaction involving digital currencies—without one, you can neither send nor receive coins. This article provides a concise overview of the main types of wallets, how to set up a Bitcoin wallet, and how to use it securely.

Every wallet must include a basic set of essential functions to work correctly. In addition, some wallets may offer extra features for enhanced security or to help users earn passive income.

We will cover all of this and more in detail in this article. For a deeper understanding of what a crypto wallet is, how it works, how to choose the right storage option, and how to protect your crypto assets, see our full guide: Bitcoin Wallet.

Main types of crypto wallets

Before we dive into how to create a Bitcoin wallet, let’s first understand what it is and the types that exist. It’s important to note that crypto wallets don’t actually store digital coins themselves—these are stored on the blockchain.

A wallet is a program or device that gives the user access to their crypto assets and enables them to manage transactions. This is done through the generation of public and private keys: the public key is used to receive coins, while the private key is used to authorize transactions and access the funds.

There are several main categories of crypto wallets, each with its own characteristics:

- Software wallets. These are apps or programs that can be downloaded to your computer or smartphone. They are easy and convenient to use, allowing quick access to your assets. However, since they are connected to the internet, they are vulnerable to hacking.

2. Hardware wallets. These are physical devices, similar to USB drives. They are considered the most secure method of storing digital currencies, as they are kept offline. Ideal for long-term storage of large sums, but less convenient for everyday use.

3. Online wallets. They are often provided by crypto exchanges, these wallets are integrated into trading platforms. Their convenience lies in allowing users to store and trade crypto in the same place. However, the exchange retains control over the user’s assets and is more susceptible to cyberattacks.

4. Paper wallets are another form of offline storage, consisting of a printed or handwritten code containing your private key. While they are immune to online threats, the major risk is physical damage or loss of the paper containing the key.

Each wallet type above has its own pros and cons. Choosing the right one depends on your specific goals and needs. For example, software or online wallets are more suitable for daily transactions, but not recommended for storing large amounts.

Comparison of different types of crypto wallets

We’ve already reviewed various types of crypto wallets. Before creating a Bitcoin wallet, it’s important to choose the one that best fits the user’s preferences. A brief comparison of different wallet types is provided in the table below:

| Parameter | Online wallet | Software wallet | Hardware wallet | Paper wallet |

| What it is | Web-based page | Mobile or desktop application | USB-like device | Piece of paper with keys |

| Type | Hot | Hot | Cold | Cold |

| Access from different devices | Yes | No | Yes (can connect to any PC) | - |

| Internet connection | Yes | Yes | No | No |

| Ease of use | Easy | Easy | Complex | Easy |

| Quick access to assets | Yes | Yes | No | No |

| Who controls the assets | Platform or exchange (custodial) | Depends on wallet type | Wallet owner | Wallet owner |

| Security level | Low | Low | High | High |

| Cost | Often free | Often free | High | Low |

| Risks | Hacks, cyberattacks, viruses, system failures | Malware, lost access if password is forgotten | Loss or damage of device | Loss or damage of paper |

As seen in the comparison table, each type of crypto wallet has its own strengths and weaknesses. It’s important to weigh the pros and cons before installing or purchasing a wallet. Additionally, choose a wallet according to your specific goals and usage needs.

Cold wallets offer higher data storage security, but they are more difficult to use and don’t provide quick access to assets due to being offline. Hot wallets are much easier to use and provide instant access to your funds, but they carry a higher risk of hacking.

How to create Bitcoin wallet

When we talk about creating a crypto wallet, we usually refer to online or software-based wallets. So, what steps should you take to create a wallet? Here’s a general step-by-step process:

- Choose a provider.

Crypto wallets are developed by various companies. You need to select a reliable and reputable service provider. Pay attention to security levels, features, and user interface convenience. - Download and install the program.

Depending on the type of wallet, download and install the software on your PC or an app from the app store on your smartphone. Online wallets don’t require installation—simply visit the provider’s website.

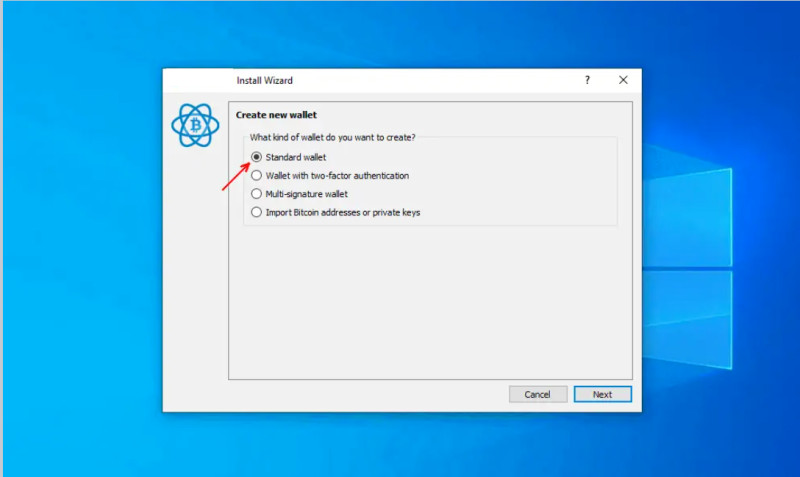

3. Create your wallet.

Select the “Create New Wallet” option in the menu and follow the instructions. Usually, you’ll need to create a username and password. The program will then generate a seed phrase, which you must write down or securely store—it’s required to recover access to your account.

4. Key generation.

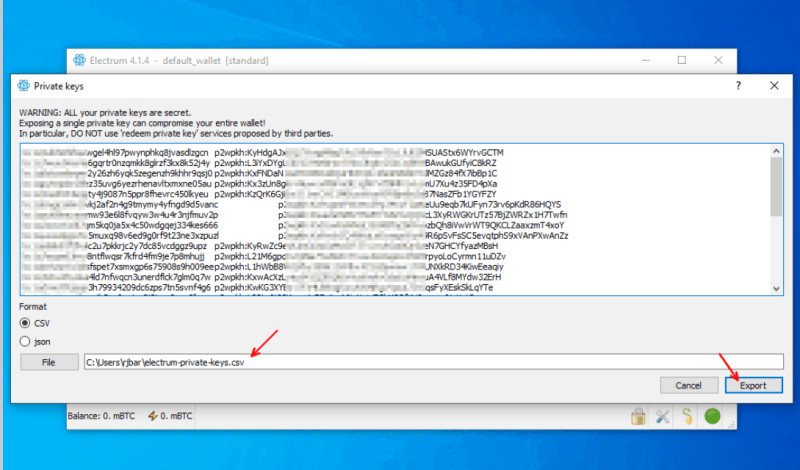

The wallet first generates a private key, which must be securely saved or written down. Then, one or more public keys will be generated. These act as addresses where others can send you cryptocurrency.

Importantly, you can—and should—share your public key with others so they can send you funds. However, your private key and seed phrase must be kept strictly confidential and securely stored.

Some wallets are multi-currency, meaning they support several digital assets. In this case, a separate pair of public and private keys is created for each currency. When making transactions, it’s crucial to use the correct address for the currency you’re sending or receiving.

Creating hardware wallet

For a hardware wallet, only two steps are required:

- Choose and purchase a device based on your preferences and budget. The most well-known and reliable hardware wallets are Ledger, Trezor, and KeepKey.

- Install the software and start using it.

Each hardware wallet comes with dedicated software needed to operate the wallet and manage your crypto assets.

What features should crypto wallet have?

What makes a good crypto wallet, and what features should it offer? After understanding how to create a Bitcoin wallet, let’s turn to its key functions and characteristics. Two essential qualities every wallet must have are security and user-friendliness, but that's not all.

- Access via a unique key. A good wallet should support various login methods: user-created password or PIN, as well as biometric options like Face ID or Touch ID.

- Session timeout. Like banking apps, wallets should automatically log out or lock after a period of inactivity for safety.

- Transaction handling. Core operations include buying and selling coins, usually labeled “Withdraw” and “Deposit.”

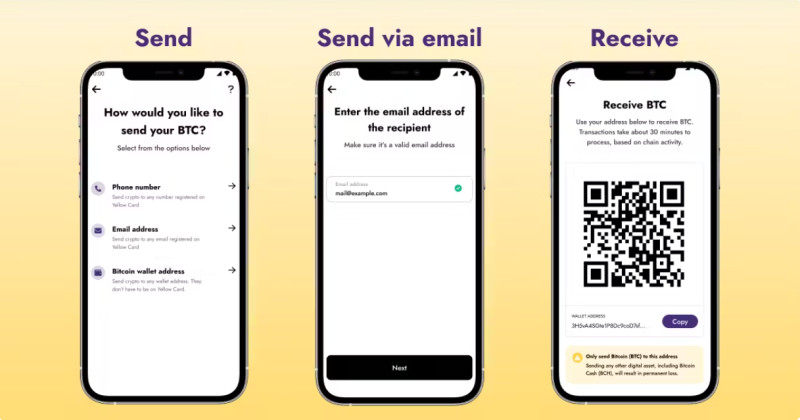

- Sending crypto to other wallets. Wallets must enable users to send currency via a recipient’s public key.

- QR-code access. QR codes allow faster access or receiving by scanning a public key, easier than typing long addresses.

- Notifications. Push alerts help track activity: confirmation codes, deposits, withdrawals—useful to detect unauthorized use.

- Live exchange-rate updates. Due to volatility, real-time rates at the time of transactions are essential.

- Multi‑OS compatibility. Support for iOS, Android, Windows etc. ensures wider adoption and usability.

Additional wallet features

Beyond these essentials, some wallets offer advanced features for extra value:

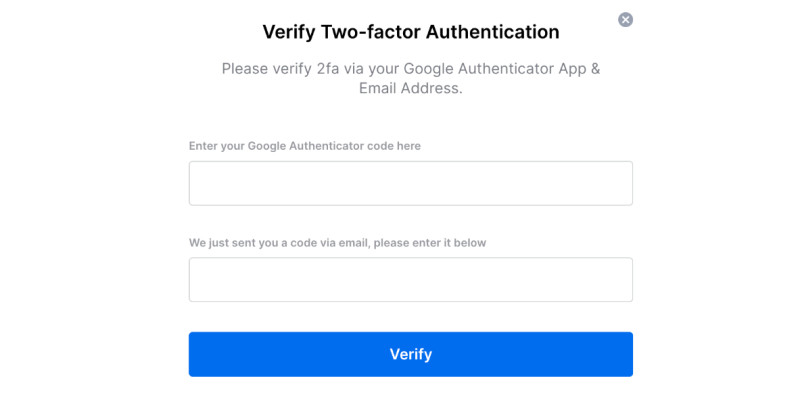

- Two‑factor authentication (2FA). Adds security by requiring both a password and a second code via SMS or email.

- Multi‑currency support. Allows managing several cryptocurrencies in one wallet instead of installing separate apps.

- Fee estimator. Calculates network fees based on congestion, helping users decide whether a transaction is worth it.

- Fiat‑crypto exchange. Not all wallets let you swap fiat and crypto directly—having this saves time and fees.

- Exchange integration. Built‑in exchange access lets users trade without external transfers, often with lower fees.

- Staking. Some wallets support staking—locking up coins to support the network in exchange for passive rewards.

Bitcoin wallet: creating and funding

Once you’ve created a Bitcoin wallet, you will need to fund it before making any transactions. There are two main options:

- Self-funding (buying crypto yourself).

- Receiving a transfer from someone else.

Sending crypto to your wallet

To receive funds, provide your public address to the sender. They’ll select the correct currency in their wallet app and use the Send function. They must enter your address, amount, and select the network, then verify all details and confirm.

Typically, a one-time code (SMS or email) or 2FA will be required. Once the transaction is confirmed, it’s irreversible.

After confirmation, you must wait for miners or validators to process the transaction. Processing time depends on the fee you set—higher fees = faster confirmation; network congestion = slower.

Funding crypto wallet for first time

If you’re buying crypto for the first time, you can:

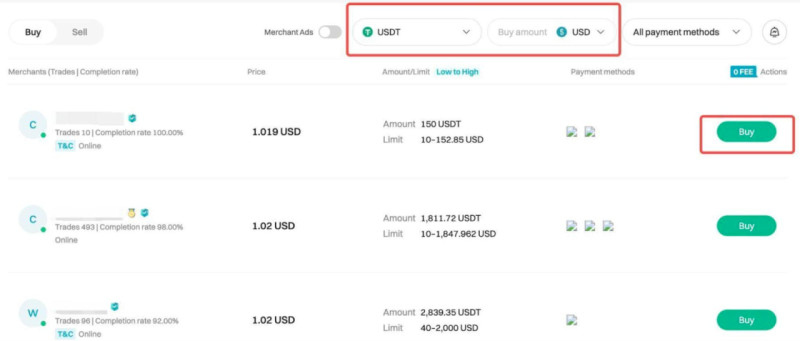

- Use a crypto exchange (e.g., Coinbase, Binance) or P2P platform to buy with your local currency, then transfer the crypto to your wallet.

- Use a fiat-to-crypto exchange or on-ramp service if your wallet supports it directly.

Once funded, you can send, receive, stake, trade, and manage your crypto assets using your wallet.

Creating Bitcoin wallet with withdrawal to bank card

Once the necessary crypto operations have been completed, a logical question arises: how can you cash out your funds? Therefore, when you decide to create a Bitcoin wallet, it’s also important to understand how to convert your earned or received digital coins into real money and withdraw it to your bank account or card.

Despite the massive popularity of cryptocurrencies, they are not considered legal tender in most countries. For this reason, any income in digital assets must typically be exchanged for fiat currency before it can be used.

Where and how can this be done?

There are several main methods:

- Cryptocurrency exchanges are one of the most popular ways to convert crypto to fiat and vice versa. Be mindful of fees, which may be higher than on other platforms. Some exchanges also charge withdrawal fees or impose limits.

- Online exchangers. These platforms set their own exchange rates, which can often be more favorable than those on exchanges, and they usually charge lower fees.

- P2P platforms. The exchange happens directly between users (buyers and sellers) who post their offers, similar to classifieds. Users choose an offer and complete the deal. Rates are user-defined and often fee-free.

- Crypto ATMs function like traditional ATMs: cryptocurrencies are converted to fiat and dispensed as cash. The downside is high transaction fees, often much higher than other options.

Once the crypto has been exchanged, the fiat funds can be withdrawn to your bank account or card. This is typically straightforward—just enter your banking details and confirm the transfer. However, note that some banks may charge a fee for incoming transfers from crypto-related sources.

How to create and protect Bitcoin wallet

The security of your wallet is directly tied to the safety of your digital assets. So, after you create your Bitcoin wallet, it’s crucial to take steps to protect it from potential threats. Here are key security tips:

- Use strong passwords. Create complex passwords (manually or using password generators). Store them securely in a safe place.

- Encrypt your wallet. You can encrypt the wallet itself or the device it's on using encryption tools to prevent unauthorized access

- Be cautious with online services. While convenient, web-based wallets and exchanges are frequent targets for hackers and should not be used as long-term storage

- Use multiple wallets. Although multi-currency wallets are convenient, spreading your crypto across several wallets increases security—if one is compromised, you don’t lose everything

- Back up your data. It’s difficult to recover a lost wallet, so maintain backups—both physical (written down) and digital (in the cloud or on a separate device)

- Update your software regularly. New versions often include improved security features to defend against evolving threats

- Store large amounts on hardware wallets. Cold wallets (offline devices) are immune to online attacks. Even physical possession of the device doesn’t grant access without the proper codes.

Conclusion

In this guide, we explained how to create a Bitcoin wallet, how to use it, how to fund it, and how to withdraw money. The type of wallet you choose depends on your individual needs. Wallets come in various forms: online, software-based, hardware, and paper. The two most important criteria are security and usability.

For everyday transactions, online or software wallets are most common. For long-term storage, hardware or paper wallets are recommended.

After selecting the right type, choose a reputable provider. Download and install the app (for software wallets) or access the platform (for online wallets). Then go through the account creation process—set up a username and password. The wallet will automatically generate a seed phrase, public key, and private key.

For hardware wallets, just buy the device and install the companion software.

Once your wallet is ready, you can fund it yourself or receive coins from others by sharing your public key.

To withdraw funds to your card or bank account, you first need to convert the cryptocurrency into fiat using one of the mentioned methods. After that, you can complete the withdrawal. Keep in mind that fees apply to nearly all steps of the process.

Back to articles

Back to articles