The emergence of digital currencies brought a revolution to the financial world, as they enabled financial transactions to be conducted without intermediaries or oversight from banks or government authorities. However, blockchain technology is even more unique, having long been used beyond the financial sphere.

In this article, we will explore the processes that preceded the creation of cryptocurrencies, the history behind the first digital currency, Bitcoin, and the subsequent development of this sector.

To learn more about other digital coins and tokens that appeared after Bitcoin, their types, and the possibilities of earning income from them, refer to the article New cryptocurrencies.

History of digital currencies

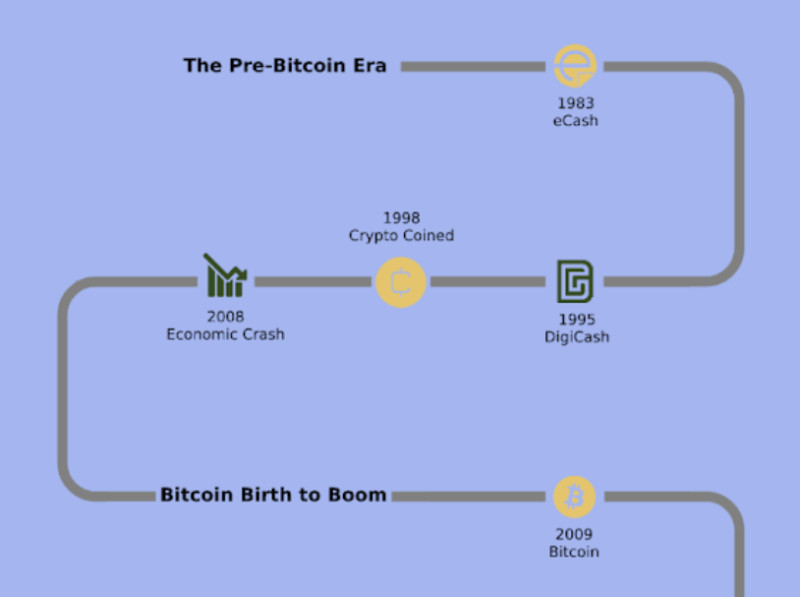

The idea of developing a digital currency emerged long before it was actually launched. The first concepts related to crypto began to appear as early as the 1980s. Therefore, before we discuss the year Bitcoin appeared, let us begin with the origins, specifically, how and by whom it all started.

The first mention of cryptocurrencies dates back to 1983, when two crypto enthusiasts, David Chaum and Stefan Brands, began working on the idea of electronic money. They described the principles of an anonymous digital payment system and later developed the protocols for "digital cash."

In 1990, Chaum and Brands founded the company DigiCash, which introduced the eCash payment system. This system ensured data privacy and protection through cryptographic encryption. The key difference between eCash and modern crypto is its centralized management.

A few years later, the company went bankrupt, but its key ideas and concepts continued to evolve. The field took a new turn thanks to Adam Back, who used the HashCash technology, a method for protecting against spam and DoS attacks. This mechanism was later improved by Hal Finney.

This technology became one of the core ideas behind the creation of the first blockchain. In 1998, two developers independently launched their own digital currency projects: Wei Dai introduced B-money, while Nick Szabo developed Bit Gold. These were the first prototypes of cryptocurrencies.

It was the concept of the B-money project that Satoshi Nakamoto later used when developing his currency, Bitcoin. In 1998, Hal Finney implemented the blockchain creation algorithm for processing operations, resulting in the first blockchain being formed. We will further discuss the importance of blockchain technology below.

Importance of blockchain and distributed ledgers

When discussing the emergence of digital currencies, it is impossible to ignore the technologies that made them possible. Therefore, before exploring the year Bitcoin appeared, it is essential to understand the nature and significance of the technological innovations that preceded it.

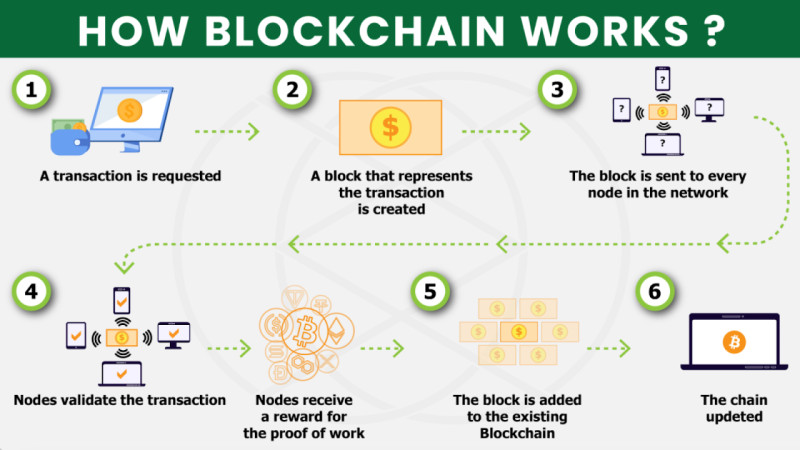

The main breakthrough in the rise of digital currencies was not the currencies themselves, but the blockchain technology that revolutionized the way data is exchanged and stored. The essence of this technology lies in the fact that data is grouped into blocks, which are then linked together in a continuous chain.

Each subsequent block contains a reference to the previous one. As a result, all operations in the blockchain are irreversible: in order to modify even a single block, all preceding blocks must also be altered. In addition, the data is not stored on a single centralized server but across multiple independent devices.

For this reason, the technology is also known as distributed ledger technology. It provides a higher level of data security because even if one or several devices fail, the information remains available on all other nodes.

Another key mechanism involved in the implementation of this technology is the consensus algorithm. This ensures agreement among all network participants regarding the number of completed transactions. Therefore, if someone attempts to maliciously alter the records, changes must be made on more than 51% of all network devices — an extremely difficult task to achieve.

The concept of this technology was first described in an article by Bitcoin’s creator, Satoshi Nakamoto. He was also the first to implement it in his cryptocurrency, Bitcoin. Transactions within such a network are anonymous yet transparent. The names of the sender and recipient remain hidden, but the transaction amounts are visible to all participants.

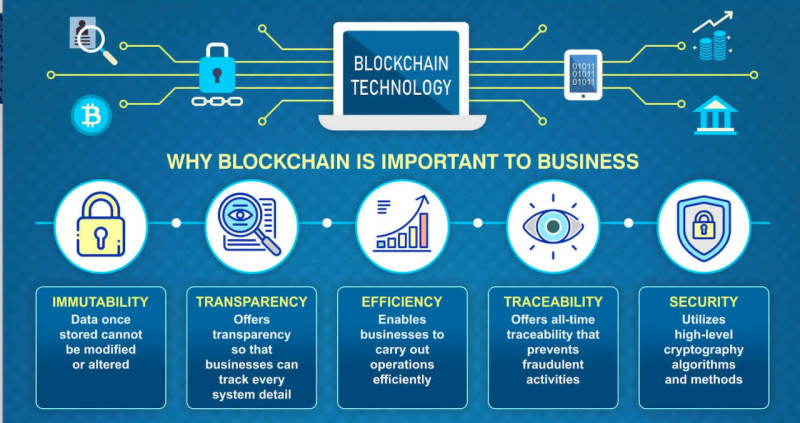

The introduction of blockchain technology significantly reduces both time and financial costs for money transfers, increases the speed of data exchange, and enhances the security of data storage. As a result, the use of this technology has expanded far beyond the crypto industry into banking, logistics, healthcare, notarial services, and many other sectors.

Why were digital currencies created?

Given all the advantages of digital currencies and the blockchain technology they are built upon, their emergence appears completely logical. But why was cryptocurrency invented and what benefits has it brought to people? Let us explore these and other questions before turning to the topic of the year Bitcoin appeared.

One of the key advantages of any digital currency is that it is not regulated by any state or government authority, unlike fiat money. The issuance and circulation of any traditional currency are fully controlled by a particular government.

Digital currencies were created as an alternative to traditional money without borders. Cryptocurrency can be transferred between countries and continents without intermediaries and with minimal fees. Thanks to blockchain technology, payments are processed within a very short time, from a few seconds to several minutes.

As mentioned earlier, all transactions on the blockchain are irreversible and anonymous. This is both a benefit and a drawback of the technology. It is a benefit because no one can determine the identity of the person making the transfer — only the addresses of the crypto wallets are visible to the public. However, this is also a drawback, as it can be used for criminal purposes.

This is precisely why cryptocurrencies have not yet been legalized in many countries and cannot be used as legal tender. Authorities fear that they may be used to finance terrorist activities, launder illicit funds, and support other criminal actions.

However, this is not the only reason why many governments impose restrictions on cryptocurrencies. Another view is that, due to their advantages, digital money could potentially replace fiat currencies, which are under full control of governments. As a result, states may lose their ability to oversee financial flows.

As already noted, blockchain technology can be used not only in the financial sector but also in many other areas where large volumes of data are processed and stored. Even in contests and lotteries, the use of this technology can make the process more transparent and fair.

Year when BTC appeared

Now that we have briefly reviewed the origins of digital currency concepts and the technology that made them possible, it is time to talk about cryptocurrencies themselves. Of course, we begin with the very first and most well-known digital coin, Bitcoin.

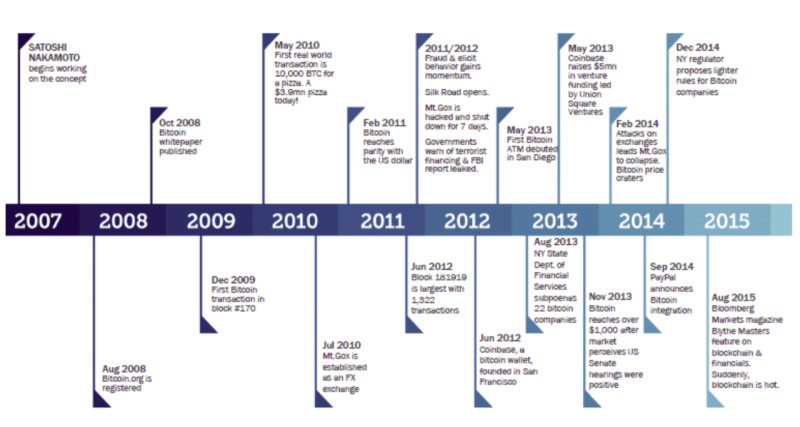

Debates about the true identity of Satoshi Nakamoto, the creator of the first digital coin, still continue. Whether it was a single person or a group remains unknown. Work on distributed ledgers began back in 2007, and by 2008, the White Paper had been released. It is the key document outlining the main features of the chain and the currency.

By early 2009, the first 50 Bitcoins (BTC) had been mined. Shortly afterward, Nakamoto completed the first-ever transaction, sending 10 BTC to another network member, who successfully received them. Later that same year, the first purchase of cryptocurrency with fiat money took place: 5,050 BTC were bought for just over $5.

Some time later, the website bitcoin.org was launched, which quickly attracted a large number of users, forming the very first crypto community. A dedicated forum was also launched on the site, helping to further popularize Bitcoin.

Mining coins was very easy at first, so regular users began mining Bitcoin on their personal computers. This contributed to the rapid rise in its popularity. Meanwhile, the developers of the blockchain worked on improving the user interface and upgraded the system to Bitcoin 2.0.

In 2010, the next version, Bitcoin 3.0, was released, and mining became more complex. Still, the number of users mining coins continued to grow, driven by Bitcoin’s rising popularity. As mining became more difficult, users started using graphics cards to boost performance.

That same year, the network experienced its first hacking incident. Due to a technical flaw in the system, hackers managed to create and send 184 billion coins to their wallets. However, the developers quickly fixed the issue, reversed the transaction, and moved the system to a new version of the protocol.

At the end of 2010, the final update to the client interface was released, and Satoshi Nakamoto left the project without giving any explanation. To this day, no one knows who was behind the pseudonym. Meanwhile, the early crypto community members continued developing and launching new digital coins.

Year BTC emerged and its original value

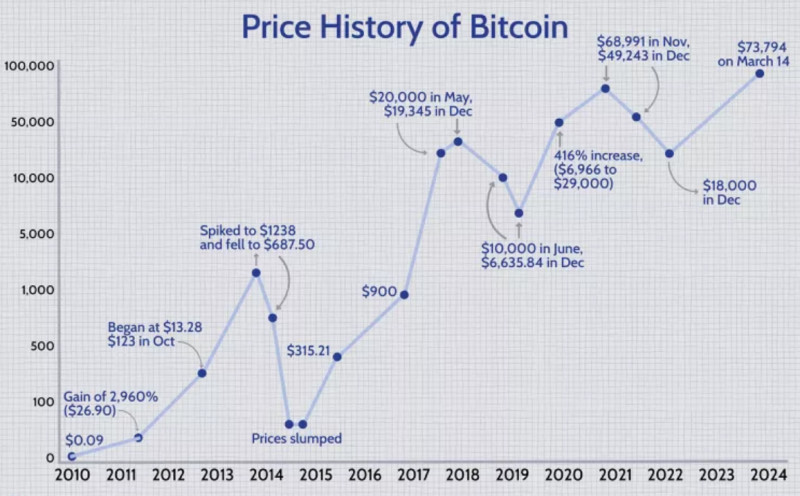

Another interesting question worth exploring when looking at the history of cryptocurrencies, and Bitcoin in particular, is how its value has changed over time. It may be hard to believe now, but at the very beginning, the price of one Bitcoin did not even reach $1.

At the time of its launch, and throughout all of 2010, the price of the first cryptocurrency remained below $1. Miners generated large amounts of coins purely out of curiosity, with no real understanding of what they could eventually do with this digital money.

If you search for the most famous purchases made with crypto, you will find one of the best-known stories of using digital currency for a real-world transaction. One miner, who owned a significant number of coins, posted on a forum offering to transfer 10,000 BTC to anyone who would order him two pizzas.

Another user accepted the offer and did, in fact, order the pizzas. In return, he received the promised coins. At the time, 10,000 BTC was roughly equivalent to $50. Just a year later, that amount had grown to $100,000. Three years later, it was worth $9 million, and today, its value exceeds $500 million.

It is unclear what the user who received the 10,000 BTC did with the coins, but the event has gone down in history as the most expensive pizza purchase ever made. It was not the only case where large amounts of Bitcoin were spent on low-cost items.

As of now, Bitcoin is worth over $50,000. It reached its all-time high in March of this year, hitting $73,780. Overall, the value of this currency has risen by more than 500,000% since its inception and nearly 400% in just the past five years.

Blockchain challenges

The emergence of the first digital currency gave rise to an entirely new industry within the financial sector. Since the introduction of blockchain technology, developers have continuously sought ways to improve it and still do today.

One of the major issues faced by many blockchains, including the Bitcoin chain, is limited scalability. This means that as the network load increases, in other words, as the number of transactions grows, the processing time also increases, resulting in a queue of unconfirmed transactions.

However, when trying to improve transaction speed, it is important not to sacrifice security or decentralization. Because of this, many developers have chosen not to enhance existing algorithms but instead to create entirely new solutions that differ from traditional approaches.

One of the clearest examples of this innovation lies in consensus algorithms. Originally, Bitcoin and many of its early successors used a single algorithm, Proof-of-Work (PoW). In this system, miners verified transactions and added them to blocks by solving complex mathematical problems.

Only one miner, the one who solved the problem first, had the right to validate the transaction, while others confirmed the accuracy. As a result, transactions could only be added one after another, in sequence, as they were verified.

Over time, the mining process became increasingly complex and energy-intensive, requiring powerful hardware and large amounts of electricity. To address this, an alternative mechanism was developed, Proof-of-Stake (PoS). In this system, the right to validate transactions is given to holders of the chain’s native cryptocurrency.

In such networks, instead of miners, there are validators who lock a certain amount of coins in their accounts. In exchange, they receive the opportunity to verify transactions and add them to blocks. This algorithm does not require high-powered devices or large energy inputs. Additionally, many variations of PoS allow for parallel processing of multiple transactions.

The key differences between these two consensus mechanisms are shown in the table below:

| Parameter | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

| Who verifies transactions | Miners | Validators |

| Equipment requirement | Required | Not required |

| Energy consumption | High | Low |

| Transaction validation method | Solving complex mathematical problems | Locking the network’s native cryptocurrency |

| Resistance to hacking | Requires control of 51% of network devices | Requires ownership of 51% of total coins |

How cryptocurrency sector evolved

In the context of discussing the first digital currency and the year Bitcoin appeared, it is important to consider how the entire crypto sphere has evolved since then. In 2011, the introduction of the BIP (Bitcoin Improvement Proposal) technology laid the foundation for launching new cryptocurrencies, so-called altcoins, as well as the first mobile applications for working with crypto.

Some developers focused on improving the existing technology. Since Bitcoin's code was open-source, several teams took advantage of it. A prime example is Litecoin (LTC), a currency created based on Bitcoin’s blockchain code. It offers faster transaction speeds and significantly lower costs.

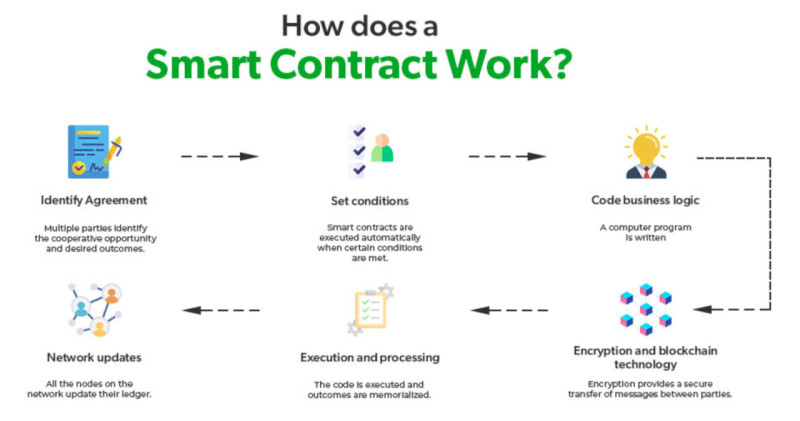

In 2012, the blockchain saw the introduction of multi-signature functionality, which made it possible to work with smart contracts. These contracts are governed by algorithms that automatically execute agreements once predefined conditions are met.

That same year, the development of cryptocurrency wallets gained momentum. Coin holders could now not only exchange crypto assets but also store them securely in both online and offline wallets.

While some developers modified or upgraded Bitcoin’s code, others took a different path, creating entirely new technologies. One of the most prominent examples is the Ethereum project, which introduced its own blockchain that is fundamentally different from Bitcoin’s.

Ethereum’s creators launched not only a new currency — Ether — but also a platform for working with smart contracts, developing decentralized applications (dApps), and creating custom tokens within its ecosystem. Each new blockchain aims to surpass its predecessors in functionality, reliability, and other key features.

What cryptocurrencies appeared after BTC

We have already mentioned some of the cryptocurrencies that emerged after the first digital coin. Given the year Bitcoin was created, it is clear how rapidly the sector has grown. In just 15 years, the number of cryptocurrencies has increased to several thousand, and that number continues to rise.

Many of the coins that appeared after Bitcoin have become just as successful and in demand. Each one has unique features that distinguish it from similar projects. Let us take a closer look at the main types of digital currencies.

Bitcoin, as the first and most well-known currency, stands in a category of its own. As mentioned earlier, all other coins created afterward are referred to as altcoins or alternative coins. However, even among altcoins, there are several different categories of crypto assets.

One common classification divides cryptocurrencies into coins and tokens. Coins are launched on their own blockchain, which requires more technical expertise and time. Tokens, on the other hand, are created on top of existing blockchains, which allows even novice users to launch them.

Cryptocurrencies are also frequently categorized based on their intended function. For example, there are utility coins that are used within a blockchain network to pay transaction fees or serve other internal purposes.

Another group includes governance tokens, which give holders the right to participate in voting on decisions about the future development of the blockchain. There are also gaming coins, used in blockchain-based games to purchase various in-game items.

A separate category is NFTs (non-fungible tokens), which are one-of-a-kind digital assets. These include digital representations of artworks, music compositions, videos, and other forms of digital content.

There are, of course, many other types of digital currencies as well.

Conclusion

In this article, we explored the key stages that led to the emergence of digital currencies, including the year Bitcoin was created and how the cryptocurrency sector has evolved since. For several years now, we have witnessed rapid growth in the crypto market.

None of this would have been possible without blockchain technology, which enables data to be encrypted, transmitted, and stored in a special format — in blocks connected to each other in a single, continuous chain. This technology ensures transactions are both secure and transparent.

The first digital coin appeared more than 15 years ago, and at that time, no one took it seriously. Mining was relatively simple, and early miners were spending thousands of Bitcoins on everyday purchases. Who could have imagined back then the heights this coin would later reach?

From the moment the first currency was launched, a community of enthusiasts began to form around it — people who went on to refine and expand the technologies behind it. They started creating new currencies, and that process not only continues today but is gaining momentum.

Recommended

How to choose the most promising cryptocurrency to invest in

Where to track new cryptocurrencies?

Cryptocurrencies with massive upside potential

Upcoming cryptocurrency listings

When cryptocurrency was invented

First cryptocurrency

Back to articles

Back to articles