Analysis of Trades and Trading Tips for the Japanese Yen

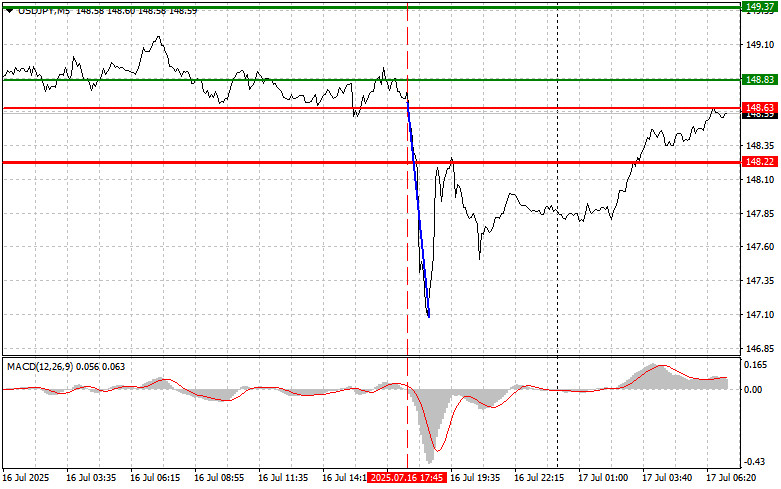

The test of the 148.63 price level coincided with the moment when the MACD indicator had just begun moving downward from the zero line. This confirmed a valid entry point for selling the dollar and resulted in a drop of over 150 points.

During the U.S. session, the yen surged sharply amid rumors that Donald Trump was seriously considering firing Federal Reserve Chair Jerome Powell, though the U.S. President later dismissed these speculations. This episode became a vivid example of how political maneuvers and market expectations can instantly shift the balance of power in the global financial system.

The initial spike in the yen was driven by investor concerns over the future independence of the Federal Reserve and the potential destabilization of the U.S. economy. The dismissal of the Fed Chair—especially on political grounds—could undermine confidence in U.S. monetary policy and trigger capital outflows. Under such conditions, the yen, traditionally seen as a safe-haven asset, naturally saw increased demand. However, Donald Trump's statement denying any plans to remove Powell quickly calmed the markets and led to a partial correction of the yen. Once investors saw no imminent threat to the Fed's independence, they began to reduce their yen positions, contributing to its weakening. This short but highly volatile period served as a reminder of how sensitive financial markets are to political news and speculation. Even unconfirmed rumors can trigger substantial movements in exchange rates and other assets.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Buy Scenario

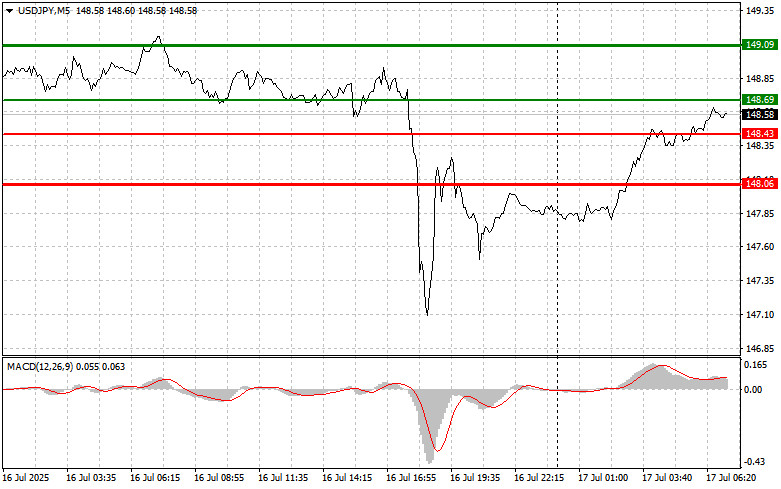

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 148.69 (green line on the chart), targeting a rise to 149.09 (thicker green line on the chart). Around 149.09, I intend to exit long positions and open shorts in the opposite direction (expecting a 30–35 point pullback). It is best to return to buying the pair during corrections and significant dips in USD/JPY.

Important! Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 148.43 level while the MACD indicator is in oversold territory. This will limit the pair's downside potential and lead to a market reversal upward. A rise toward the opposing levels of 148.69 and 149.09 can be expected.

Sell Scenario

Scenario #1: I plan to sell USD/JPY today only after the price breaks below 148.43 (red line on the chart), which may lead to a sharp decline in the pair. The key target for sellers will be 148.06, where I intend to exit short positions and immediately open long positions in the opposite direction (aiming for a 20–25 point rebound). Strong pressure on the pair is unlikely today.

Important! Before selling, make sure that the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 148.69 level, while the MACD indicator is in overbought territory. This would limit the pair's upward potential and lead to a downward reversal. A decline toward 148.43 and 148.06 can then be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.