EUR/USD H1 Chart – Thursday Trade Review

On Thursday, the EUR/USD currency pair continued its weak downward movement in line with the current trend. We've been saying the same thing all week because very little is changing in the market. The pair is gradually slipping lower each day, there is a complete lack of macroeconomic background, and fundamental events (primarily related to the global trade war) are discouraging traders from buying the dollar. Thus, we still believe the current movement is merely a technical correction, which doesn't require much justification.

Currently, the price has encountered the 1.1666 level on its way down. Therefore, a rebound and a rise at least toward the trendline are highly likely. Even though the dollar has been rising this week against all odds, confirmation of the end of the downtrend would require a firm break above the trendline.

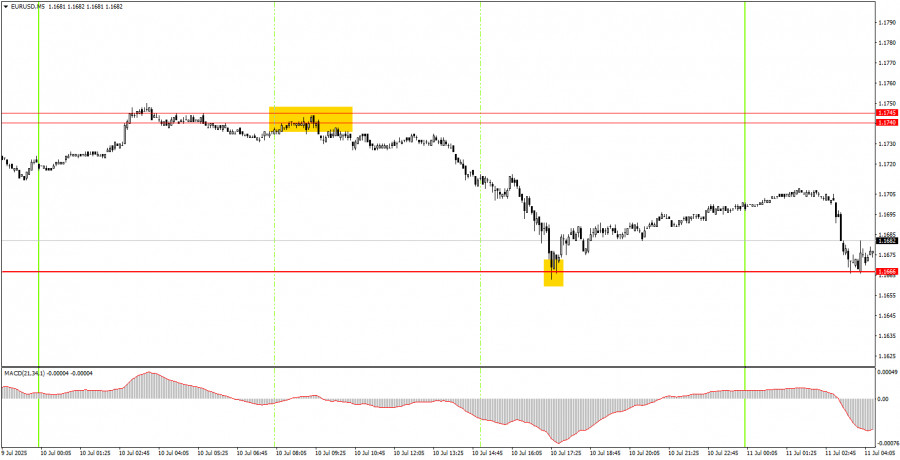

EUR/USD 5M Chart – Thursday Trade Review

On the 5-minute timeframe, two excellent trading signals were formed on Thursday. During the European session, the price rebounded from the 1.1740–1.1745 level and dropped to the 1.1666 level. In the U.S. session, the price rebounded from that level. Thus, novice traders could have opened short positions in the morning and long positions in the afternoon. The long trade didn't bring much profit, but the short one yielded at least 50 points.

How to Trade on Friday

On the hourly timeframe, EUR/USD continues its correction, but the five-month uptrend remains intact. For the U.S. dollar to consistently decline, it's still enough that Donald Trump is the U.S. president. Naturally, the dollar needs to correct from time to time (which is what we are seeing now), but the overall fundamental background remains such that expecting strong growth from the U.S. currency is still very difficult. The pair may continue its mild decline this week, but a breakout above the downward trendline would signal the start of a new uptrend.

On Friday, the EUR/USD pair may attempt to break the strong 1.1666 level, but two previous rebounds from this level suggest at least a move up to the trendline. A consolidation below 1.1666 would indicate continuation of the downtrend.

On the 5-minute timeframe, the following levels should be considered: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1561–1.1571, 1.1609, 1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908.No significant or interesting events are scheduled in the EU or U.S. on Friday. Thus, the only potential market mover today remains Donald Trump. The market has been ignoring his new tariffs this week, which makes the 1.1666 technical level more important at this stage.

Main Trading System Rules:

- Signal Strength depends on the time it takes to form (a rebound or breakout of a level). The less time it takes, the stronger the signal.

- If two or more false trades were opened around a level, ignore all future signals from that level.

- In flat markets, any pair can produce many false signals or none at all. It's best to stop trading at the first signs of a flat market.

- Trades are to be opened during the European session up to mid-U.S. session. All positions should be closed manually after that period.

- On the H1 timeframe, MACD signals should be used only when there is good volatility and a confirmed trend supported by a trendline or trend channel.

- If two levels are too close to each other (5–20 points), consider them a single support/resistance zone.

- If the price moves 15 points in the right direction, set the Stop Loss to breakeven.

What's on the Charts:

- Support and resistance levels: Price targets for trades. Take Profit levels can be placed near them.

- Red lines: Channels or trendlines showing the current trend and preferred trading direction.

- MACD Indicator (14,22,3): Histogram and signal line – an auxiliary tool that can also provide signals.

- Important speeches and reports (always listed in the news calendar) can strongly influence currency pair movement. Trade cautiously or exit the market during such events to avoid sudden reversals.

Final Note for Beginners:

New Forex traders should remember that not every trade will be profitable. Developing a clear strategy and practicing sound money management are key to long-term success in trading.