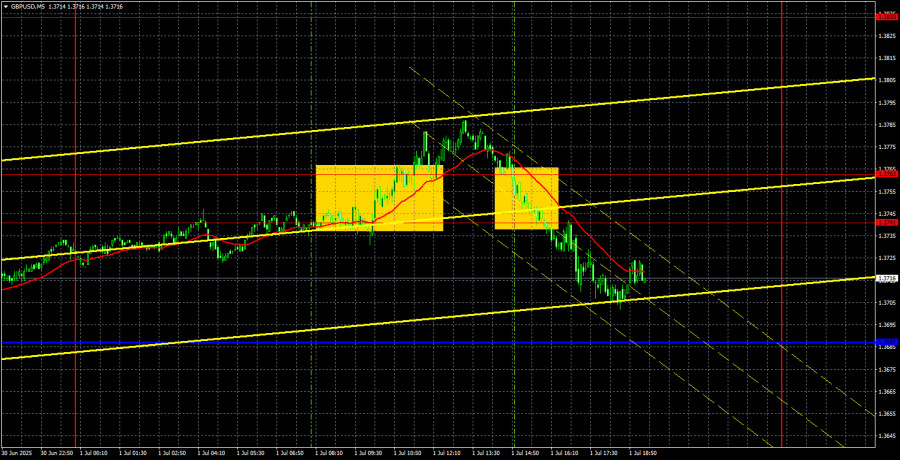

GBP/USD 5-Minute Analysis

On Tuesday, the GBP/USD currency pair began a modest downward movement in the second half of the day but remained above the critical Kijun-sen line. Thus, for now, there is no sign of a trend reversal, even on the hourly timeframe, let alone higher ones. On Tuesday, the macroeconomic background was relatively weak, and it certainly wasn't the not-so-positive ISM Manufacturing PMI in the U.S. that triggered the dollar's strengthening, which had started several hours before its release. Manufacturing activity rose from 48.5 to 49.0 points—still below the 50.0 "waterline." Meanwhile, JOLTS job openings in May reached 7.769 million versus a forecast of around 7.3 million. Therefore, there was a formal basis for dollar appreciation. But how long will the dollar's strength last?

We believe the U.S. dollar is unlikely to strengthen significantly in the near future. Of course, if it breaks below the Kijun-sen line, at least technical grounds for a decline would appear. Perhaps the situation with Elon Musk might help the dollar, since many in the U.S. (and around the world) would welcome Trump's resignation. So if Musk creates his political party and Trump continues to make decisions that only worsen the situation, the dollar might even get a boost. However, for now, this is all speculation.

In the 5-minute timeframe, two trading signals were generated, neither of which was noteworthy. It's extremely hard to believe in the pair's decline at the moment, so sell signals are hardly a priority. The buy signal in the 1.3741–1.3763 area turned out to be false.

COT Report

COT reports for the British pound indicate that commercial traders' sentiment has shifted constantly over the past few years. The red and blue lines, representing the net positions of commercial and non-commercial traders, frequently cross and typically remain near the zero line. Currently, they are also close to each other, indicating a roughly equal number of buy and sell positions. However, over the past year and a half, the net position has been increasing.

The dollar continues to weaken due to Trump's policies, making sterling demand among market makers less relevant at the moment. The trade war will continue in some form, and the Fed's key interest rate may drop significantly in the coming years — more than the economic outlook justifies. Thus, demand for the dollar will fall regardless. According to the latest COT report on the pound, the "Non-commercial" group closed 6,400 buy contracts and 2,000 sell contracts. This means the net position shrank by 8,400 contracts, but this carries virtually no significance.

In 2025, the pound has seen a sharp increase, but there's one main reason — Trump's policies. Once this factor fades, the dollar could start recovering. But when that happens, it is anyone's guess. Trump is only at the beginning of his presidency, and the next four years may bring many more shocks.

GBP/USD 1-Hour Analysis

On the hourly timeframe, the GBP/USD pair continues its upward march. After moving sideways for several days, the market has had time to rest, regain strength, and now may resume a strong upward trend. The dollar will have a chance only if the price drops below the Kijun-sen line. In that case, a decline toward the Senkou Span B line at 1.3508 could be expected. However, we all know that the current fundamental backdrop from the U.S. is such that the dollar could crash at any moment.

For July 2, we identify the following important levels: 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537, 1.3615, 1.3741–1.3763, 1.3833, 1.3886. The Senkou Span B (1.3508) and Kijun-sen (1.3687) lines may also serve as signal sources. It's recommended to set the Stop Loss to breakeven after a 20-pip move in the correct direction. The Ichimoku indicator lines may shift during the day, which should be taken into account when determining trading signals.

On Wednesday, there are no significant events or reports scheduled in the UK. In the U.S., the ADP report on private sector employment is expected. This report is considered a "younger brother" of Non-Farm Payrolls, which will be released on Friday. We don't expect a strong reaction to the ADP, but that doesn't mean traders won't have other reasons to trade actively throughout the day.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.