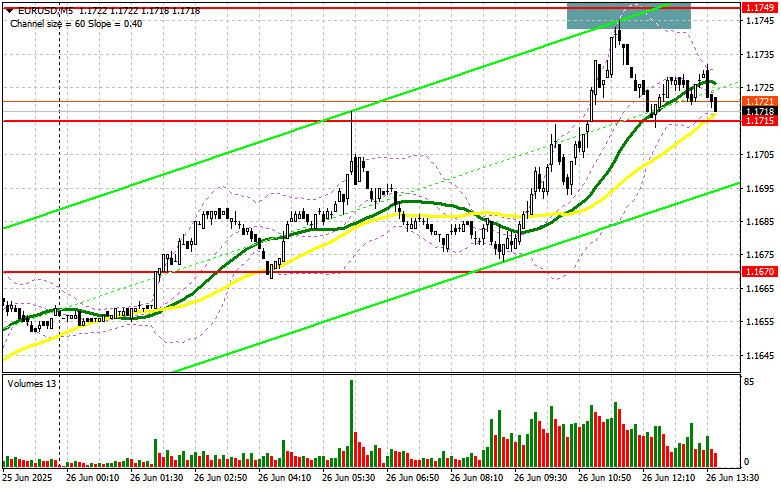

In my morning forecast, I focused on the 1.1749 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. Although the pair moved higher, it never reached this range, so I didn't enter any trades. The technical outlook was revised for the second half of the day.

To open long positions on EUR/USD:

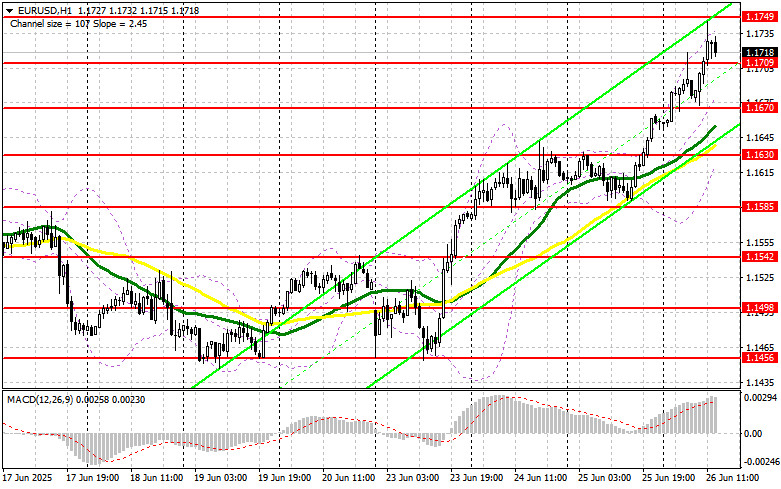

Yesterday's bullish momentum, triggered by Trump's criticism of Powell, persisted in the first half of the day. The absence of significant data from the eurozone helped EUR/USD extend gains. Today's second half of the day is packed with U.S. statistics. It starts with the final GDP data for Q1 and the Core PCE Price Index, followed by weekly jobless claims and durable goods orders. FOMC members Thomas Barkin and Michael S. Barr are also scheduled to speak, which may attract additional attention.

If the pair declines after the data—keep in mind that the euro is strongly overbought—I will only act around the new support at 1.1709. A false breakout at that level will be a signal to buy EUR/USD in anticipation of a rebound and a retest of the 1.1749 resistance, which fell just short of being reached earlier in the day. A breakout and retest of this range would confirm the correct entry point, opening the way to 1.1775. The ultimate target would be 1.1806, where I would take profit.

If EUR/USD declines and there's no buying interest around 1.1709, pressure on the pair will increase significantly, likely leading to a deeper drop. In that case, bears could push the pair toward 1.1670. Only after a false breakout form will I consider buying the euro. Otherwise, I will open long positions on a rebound from 1.1630, aiming for a 30–35 point intraday upward correction.

To open short positions on EUR/USD:

Sellers made their presence felt after the pair updated its monthly high, but the movement so far remains a correction. Only very strong U.S. data could restore pressure on the pair. If the data disappoints, further euro growth is likely. In that case, a false breakout at 1.1749 will be a signal to open short positions with a target at 1.1709. A breakout and consolidation below that range would be an opportunity to sell, with the next target near 1.1670, where the moving averages—currently supporting bulls—are located. The ultimate downward target is 1.1630, where I would take profit.

If EUR/USD rises again in the second half of the day and there is no strong bearish activity around 1.1749, buyers may push the market higher and update 1.1775. I would only consider short positions there after a failed breakout. Alternatively, I will open short positions on a rebound from 1.1806, targeting a 30–35 point downward correction.

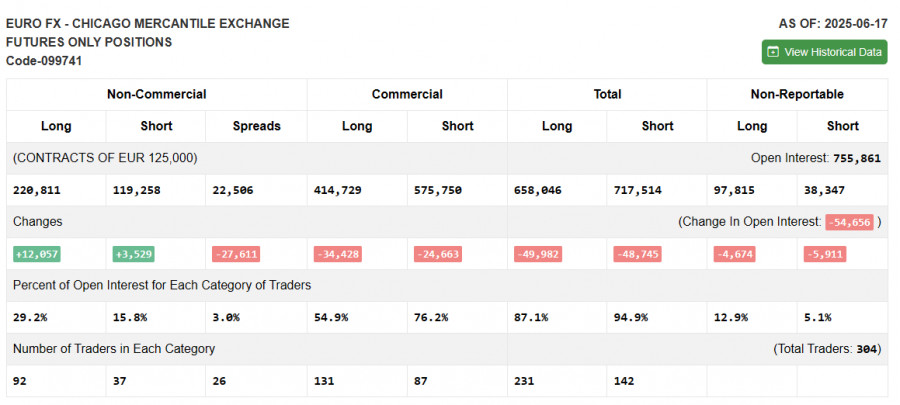

COT Report (Commitment of Traders) – June 17

The latest COT report showed an increase in both long and short positions. The Fed's decision to leave rates unchanged positively affected the dollar's position, but the primary driver of growth remained the conflict in the Middle East. Upcoming data on U.S. economic growth could influence the Fed's plans, which in turn will determine the future direction of EUR/USD.

According to the COT report, non-commercial long positions rose by 12,057 to 220,811, while non-commercial short positions increased by 3,529 to 119,258. As a result, the gap between long and short positions narrowed by 27,611.

Indicator Signals:

Moving AveragesTrading is taking place above the 30- and 50-day moving averages, indicating further euro strength.Note: The author uses H1 (hourly) chart settings, which differ from traditional daily (D1) moving average interpretations.

Bollinger Bands In the event of a decline, the lower band around 1.1630 will act as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing out price fluctuations and noise. Period – 50 (yellow line on the chart).

- Moving Average (MA): Period – 30 (green line on the chart).

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12; Slow EMA – 26; SMA – 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as retail traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions among non-commercial traders.