Bitcoin and Ethereum continued their rally yesterday, triggered by news of a ceasefire between Iran and Israel. Federal Reserve Chair Jerome Powell's dovish tone during his testimony in the House of Representatives also allowed investors and traders to focus on buying risk assets, including those denominated in cryptocurrencies.

Meanwhile, Bitcoin dominance rose again to 62% after a notable drop to 59% in May this year, reflecting Bitcoin's market capitalization relative to the total market capitalization of all crypto assets. This resurgence in dominance can be explained by several factors, including rising uncertainty around altcoins and their resilience, as well as Bitcoin's strengthened status as "digital gold" during times of economic and geopolitical instability — of which there is plenty right now. Investors, wary of volatility and regulatory risks associated with many altcoins, are increasingly turning to Bitcoin as a proven and relatively safer option within the crypto space. This trend is reinforced by macroeconomic factors such as inflation and geopolitical risks.

It is worth noting that this indicator serves as an important barometer of market sentiment and the potential onset of an altcoin season. A drop in Bitcoin dominance typically signals increased investor interest in alternative cryptocurrencies. The current upward trajectory suggests that capital flows continue to favor Bitcoin over smaller digital assets, potentially delaying the start of a broader altcoin rally that had recently begun to attract speculation again.

The recovery in dominance also reflects a divergence in investment patterns. While cryptocurrency is gaining popularity among traditional financial institutions, altcoins have not yet experienced the same institutional hype as Bitcoin. The range of options available to investors also affects investment behavior.

As for an intraday crypto market strategy, I will continue to rely on any major pullbacks in Bitcoin and Ethereum to take positions in anticipation of a continued bullish trend in the medium term — a trend that is still intact.

For short-term trading, the strategy and conditions are described below.

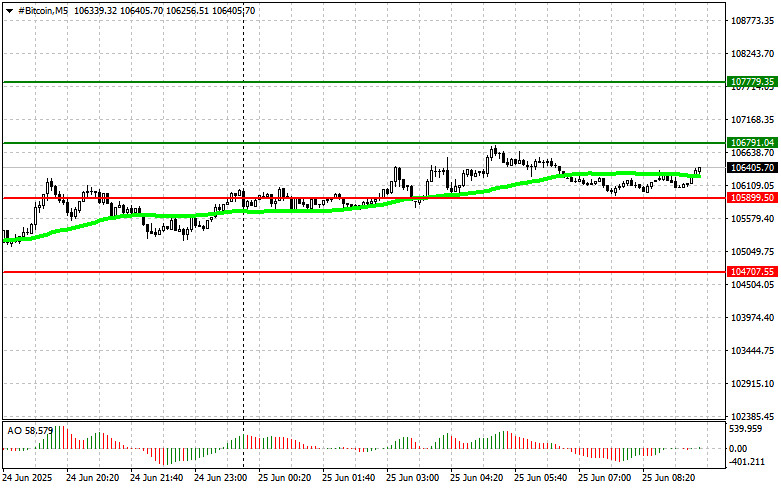

Bitcoin

Buy Scenario

Scenario #1: I plan to buy Bitcoin today if the entry point of $106,800 is reached, with a target of $107,700. I will exit the buy position around $107,700 and immediately open a sell position on the rebound. Before buying on a breakout, make sure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buying from the lower boundary at $105,900 is also possible if there is no strong market reaction to its breakout, with a rebound toward $106,800 and $107,700.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today if the entry point of $105,800 is reached, with a target of $104,700. I will exit the sell position around $104,700 and immediately open a buy position on the rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Selling from the upper boundary at $106,800 is also possible if there is no strong market reaction to its breakout, with a pullback toward $105,900 and $104,700.

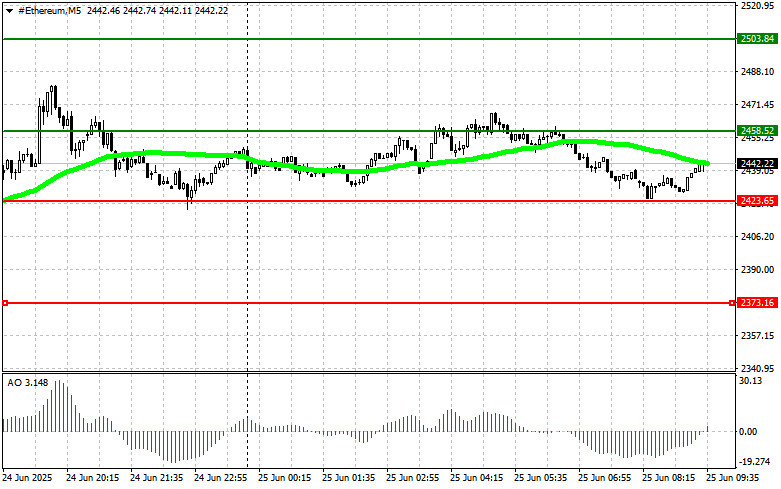

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today if the entry point of $2,458 is reached, with a target of $2,503. I will exit the buy position around $2,503 and immediately open a sell position on the rebound. Before buying on a breakout, make sure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buying from the lower boundary at $2,423 is also possible if there is no strong market reaction to its breakout, with a rebound toward $2,458 and $2,503.

Sell Scenario

Scenario #1: I plan to sell Ethereum today if the entry point of $2,423 is reached, with a target of $2,373. I will exit the sell position around $2,373 and immediately open a buy position on the rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Selling from the upper boundary at $2,458 is also possible if there is no strong market reaction to its breakout, with a pullback toward $2,423 and $2,373.