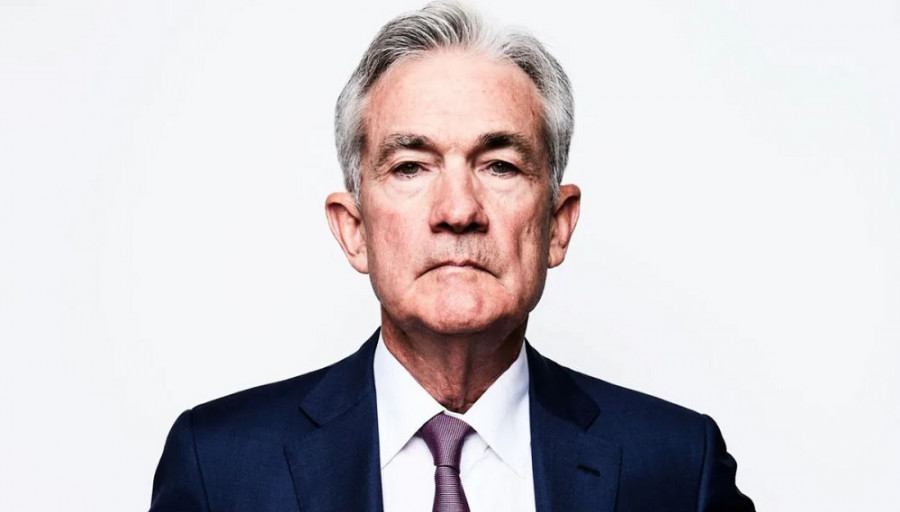

Starting June 24, Fed Chair Jerome Powell will address Congress over two days, delivering the semiannual monetary policy report. On Tuesday, he will speak before the Senate Banking Committee, and on Wednesday, he will appear before the House Financial Services Committee.

Throughout the year, there are only a few key scheduled events featuring the Fed Chair (excluding post-meeting press conferences). These include the economic forum in Sintra, Portugal, the international symposium in Jackson Hole, and events organized by the Economic Club of Washington. However, in those venues, the Chair operates more autonomously—while moderators or participants may ask questions, Powell can often deflect or give vague answers. In contrast, the semiannual congressional testimonies stand apart. The questions come from lawmakers, prompting more concrete and comprehensive responses. This is what gives Powell's "two-day marathon" particular significance.

What Might Powell Discuss? Will He Trigger Volatility in EUR/USD?

Let's first recall Powell's key messages from the recent June FOMC press conference. The main theme: elevated inflation. Powell reiterated that the Fed will pause rate cuts until the full effects of new tariff policies are understood—specifically, how significantly tariffs influence inflation. The Fed also updated its macroeconomic projections, lowering expectations for GDP growth while raising forecasts for inflation and unemployment.

Powell "anchored" any future rate cuts to inflation trends, pointing to uncertainties in trade policy—particularly since the so-called "grace period," during which a flat 10% tariff is applied, ends in July and will transition to individualized tariffs.

This was the central message of the June FOMC meeting, after which markets concluded that the Fed would maintain a wait-and-see stance at least until September. Nevertheless, the median forecast (dot plot) projects two rate cuts before year-end.

Powell will likely repeat these key messages during this week's congressional testimonies. If so, markets may largely ignore his remarks.

However, there is a slim chance Powell could adopt a more hawkish tone in light of recent developments in the Middle East—voicing concerns that rising oil prices may exacerbate U.S. inflation.

Still, Powell will unlikely rush to any conclusions, especially since oil prices declined in the latter half of the day after an initial surge. It's worth noting that the June FOMC meeting took place after Israel launched its first strikes on Iranian targets. Yet the Fed disregarded the escalation despite market anxiety over oil at the time.

According to ICE data, the August Brent crude futures dropped over 5% within the past 24 hours, falling to $74.88 per barrel. The decline in oil was driven by reduced odds of the Strait of Hormuz being closed. Although Iran's parliament approved a proposal to block the Strait, the final decision rests with the Supreme National Security Council.

Currently, the Strait remains open, and some analysts believe Iran may ultimately refrain from closure, as doing so would cut off its own oil exports. So far, Israeli and U.S. airstrikes have not targeted oil infrastructure, meaning Iran can continue crude exports. Unless this changes, the Strait of Hormuz will likely stay open.

All of this suggests Powell will most likely repeat the conclusions from the June FOMC meeting:

- Inflation remains above target

- The Fed is well-positioned to stay patient

- The impact of tariffs remains uncertain

- That impact depends on final tariff levels (pending negotiations)

- The current tariff policy is likely to raise prices and weigh on economic activity

The word "uncertainty" will likely be used frequently during Powell's testimony.

However, if the Fed Chair does not deviate significantly from the established message, his remarks will unlikely spark a surge in market volatility. Geopolitics will continue to dominate the market tone.

For instance, Reuters reports that the White House considers a retaliatory Iranian strike on U.S. forces to be "highly likely." Anonymous officials say a response could come "within the next one or two days," although Washington still hopes for a diplomatic resolution.

In response to these developments, Qatar has closed its airspace "until further notice," the UK Foreign Office has advised its citizens to avoid travel to the UAE and Qatar.

A renewed escalation in the Middle East will indirectly support the U.S. dollar. But if the Iranian retaliation (if it happens) is largely symbolic—enough for Washington to ignore—it may restore risk appetite. In that case, EUR/USD buyers may regain control, with the pair likely returning to the 1.1550–1.1620 range.