Analysis of Trades and Trading Tips for the Japanese Yen

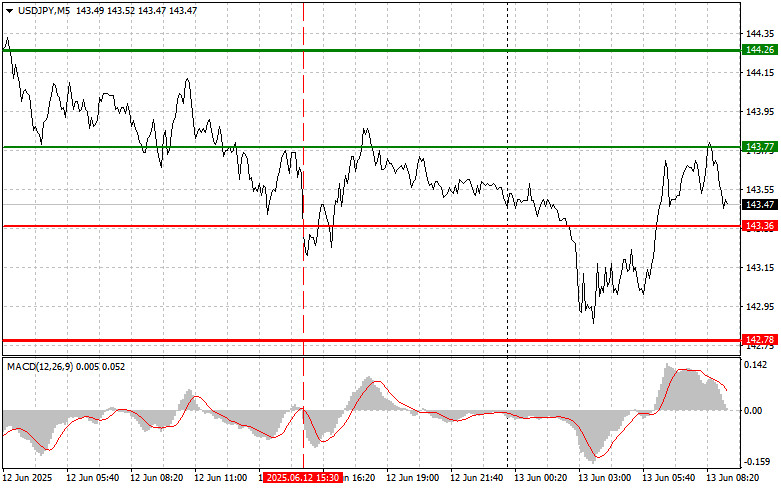

The test of the 143.36 level occurred when the MACD indicator had just started moving downward from the zero line, confirming a valid entry point for selling the dollar. However, the pair did not decline afterward, which led to a recorded loss.

Yesterday's news that U.S. producer prices came in lower than economists had expected triggered a further decline in the U.S. dollar and strengthened yen. This unexpected deviation from forecasts immediately impacted the currency markets, causing volatility and prompting investors to reassess their strategies. The yen, which had long been under pressure, received much-needed support and experienced a sharp rise in value.

However, today's Israeli strike on Iran brought demand back to the dollar and triggered a sell-off in risk assets. The geopolitical tensions that suddenly flared up in the Middle East instantly affected global markets, causing a flight from risk and a capital shift toward safe-haven assets. Traditionally viewed as a safe haven during turbulent times, the U.S. dollar regained strength while stocks, cryptocurrencies, and commodities came under pressure.

In the short term, demand for the dollar will likely persist as geopolitical tensions remain elevated. Much will depend on how the situation unfolds and how the international community responds.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Buy Scenario

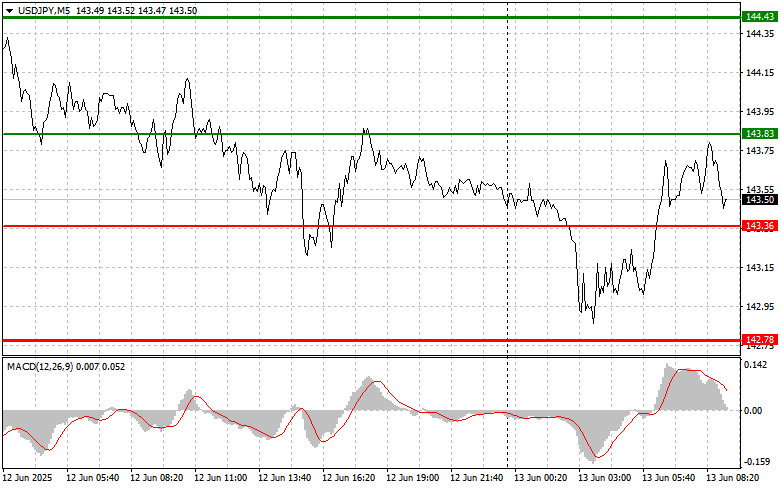

Scenario #1: Today, I plan to buy USD/JPY upon reaching the entry point near 143.83 (green line on the chart), with a target of rising to 144.43 (thicker green line). Around 144.43, I intend to exit long positions and open short positions in the opposite direction (anticipating a pullback of 30–35 pips from the level). It is best to return to buying the pair during corrections and significant USD/JPY pullbacks.

Important: Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 143.36 level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger an upward reversal. A rise toward the opposite levels of 143.83 and 144.43 can be expected.

Sell Scenario

Scenario #1: I plan to sell USD/JPY today only after a breakout below the 143.36 level (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be 142.78, where I plan to exit short positions and immediately open long positions in the opposite direction (aiming for a 20–25 pip rebound). Selling pressure on the pair could return quickly today.

Important: Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 143.83 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A drop toward the opposite levels of 143.36 and 142.78 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.