Analysis of Trades and Trading Tips for the British Pound

The test of the 1.3513 level occurred when the MACD indicator had already risen significantly above the zero line, which limited the pair's upside potential. For this reason, I did not buy the pound. I also did not get any other entry points into the market.

Yesterday, weak labor market data from the UK led to a sell-off of the British pound. The unexpected rise in unemployment and the slowdown in wage growth have raised concerns about the outlook for the UK economy and expectations for further actions by the Bank of England. The market responded instantly to the negative reports, weakening the pound against its major counterparts. Then, at the start of the North American session, the pound attempted a correction, but it was short-lived. Ongoing economic uncertainty and persistent inflation continue to weigh on the currency. Technical factors also played a role, as the breach of key support levels strengthened the bearish momentum.

It was also reported yesterday that after an exhausting twelve-hour round of negotiations, U.S. representatives announced that China had committed to increasing the supply of rare earth metals—vital for the American automotive and defense industries. In return, Washington would ease certain export control restrictions. This points to progress in resolving two of the most contentious issues in bilateral relations.

Today, no UK economic reports are scheduled, making a return of buyers to the market rather unlikely. The absence of catalysts in the form of economic releases leaves investors without clear guidance for making informed decisions. In such an environment, uncertainty increases, and market participants tend to adopt a wait-and-see approach, fearing missteps.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

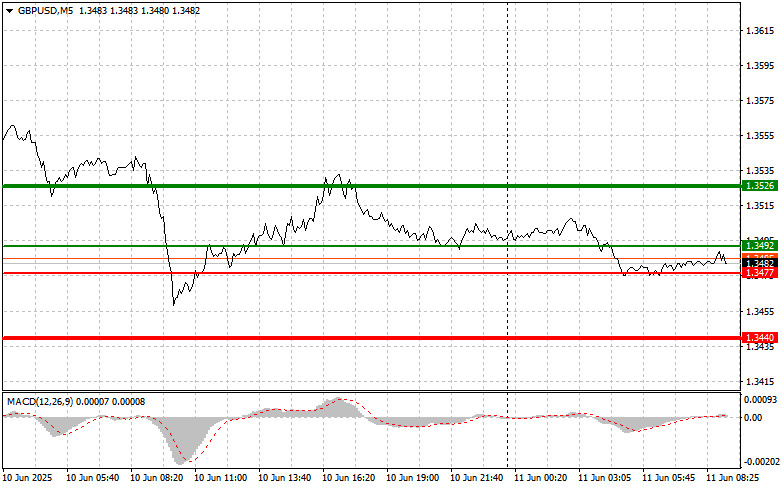

Scenario #1: I plan to buy the pound today if the entry point at 1.3492 (green line) is reached, with a target at 1.3526 (thicker green line on the chart). Around 1.3526, I plan to exit the long positions and open short positions in the opposite direction, aiming for a 30–35 pip pullback. However, a sustained rise in the pound is unlikely today.

Important: Before buying, ensure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3477 level while the MACD is in the oversold area. This would limit the pair's downside potential and trigger an upward reversal—expected targets: 1.3492 and 1.3526.

Sell Scenario

Scenario #1: I plan to sell the pound after a break below 1.3477 (red line on the chart), which should lead to a sharp decline. The key target for sellers will be 1.3440, where I intend to exit shorts and open longs in the opposite direction, aiming for a 20–25 pip rebound. Selling the pound is justified after a failed attempt to break through the daily high.

Important: Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the pound in case of two consecutive tests of the 1.3492 level while the MACD is in the overbought area. This would limit the pair's upside potential and lead to a reversal downward—expected targets: 1.3477 and 1.3440.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.