The EUR/USD currency pair traded very sluggishly on Monday. That's unfortunate because the news background becomes more interesting each day. This time, the news was not about trade tariffs, new threats from Trump, or Powell's dismissal. There were also no macroeconomic reports on Monday. However, it became known that mass protests, riots, and unrest had started in the US. Naturally, they are tied to the figure of Donald Trump.

Frankly, it's difficult to determine what needs to occur in a country like the United States for Americans to truly grasp what Trump represents. We were genuinely surprised that American voters elected a Republican president for a second term. Let's recall that Trump left office after his first term in scandal. He even attempted to storm the Capitol when Joe Biden won the election. It turns out the first Trump presidency didn't teach Americans anything. Did they want a strong leader instead of the passive Biden or the questionable Harris? Well, here he is. Now, unrest, protests, rallies, rising prices, and economic decline are America's harsh daily reality.

In Los Angeles and other U.S. cities, mass protests and riots have continued for the fourth consecutive day. People took to the streets to protest Trump's immigration policy. Briefly summarized, it goes like this: America for Americans and everyone else should go home. Maybe it sounds logical, but what about the law? If the current legislation allows immigration, it must be changed first, and only then can one act toward people who legally entered the U.S. and found employment. The same applies to illegal immigrants. If they are undocumented, there must be a legal process to prove their status, and only then can deportation occur. If America claims to be a democratic country, then it must adhere to its own laws.

However, Trump doesn't want to wait for due process for each individual case. He wants to achieve his goals by force. And we've already seen how well that worked out in the trade war. Despite tariff reductions for three months, not a single trade deal was signed in the first two months. Sure, deals may eventually get signed, but for now, there are none. Trump decided to raise import tariffs to the sky, hoping the rest of the world would get scared and come running to pay up—or offer deals that benefit no one but Trump. Many experts believe that the current prosperity of the U.S. stems from its open economy and free trade. In other words, the wealth of the U.S. is based on its historical practice of trading with everyone without barriers. However, Trump decided to increase budget revenue in this peculiar way. So far, it smells like failure.

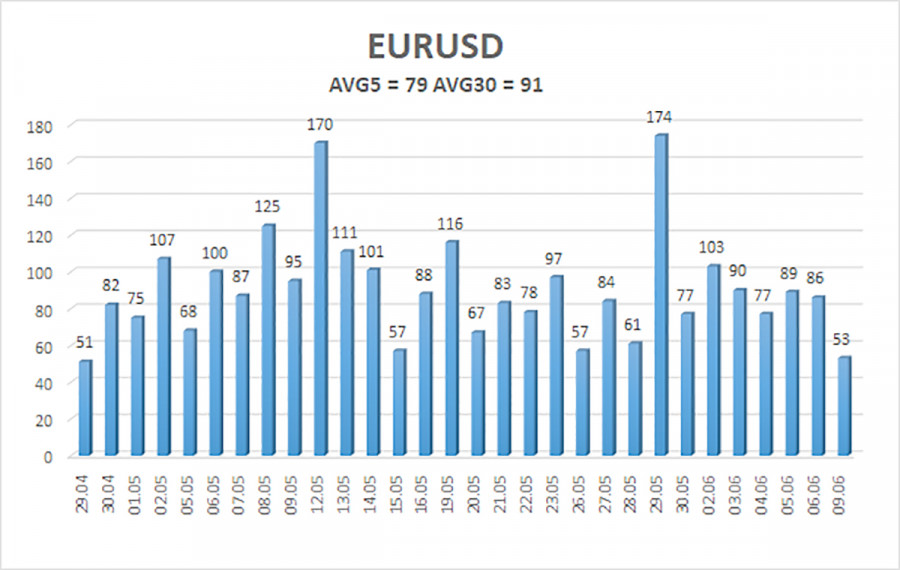

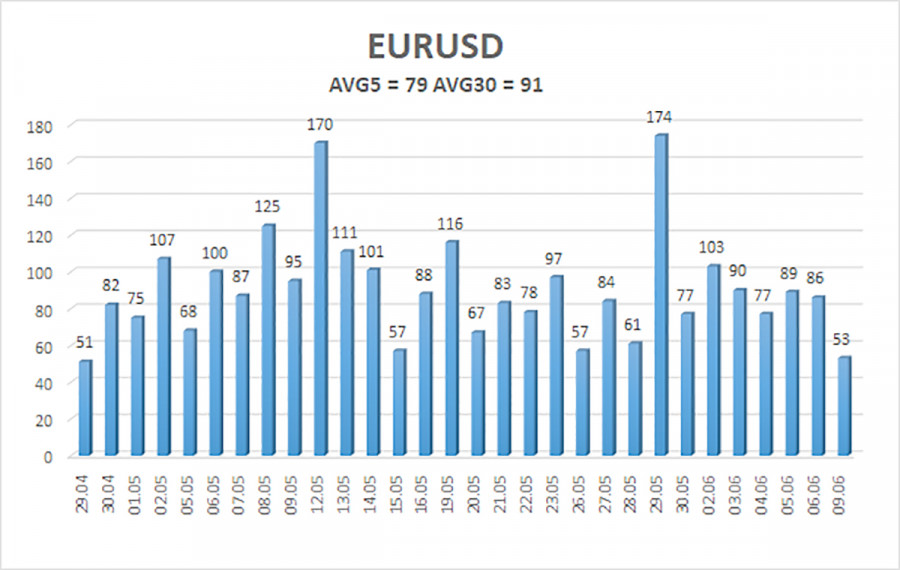

The average volatility of the EUR/USD currency pair over the last five trading days as of June 10 is 79 pips, which is classified as "moderate." We expect the pair to move between the levels of 1.1353 and 1.1510 on Tuesday. The long-term regression channel points upward, which still indicates a bullish trend. The CCI indicator entered the oversold zone and formed a bullish divergence, which triggered a resumption of the uptrend.

Nearest Support Levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1536

R3 – 1.1597

Trading Recommendations:

The EUR/USD pair is attempting to resume its uptrend. In recent months, we have consistently said that we expect the euro to decline in the medium term because the dollar still has no real reason to fall—except for Donald Trump's policies, which are likely to have destructive and long-term consequences for the U.S. economy. Nevertheless, we continue to observe a complete unwillingness by the market to buy the dollar, even when reasons exist, and a total disregard for any positive factors (which, to be fair, are few).

If the price is below the moving average, short positions with targets at 1.1353 and 1.1292 are relevant, though a substantial drop should not be expected under current circumstances. Long positions may be considered above the moving average line, with targets at 1.1475 and 1.1510.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.