Trade Review and Tips for Trading the Euro

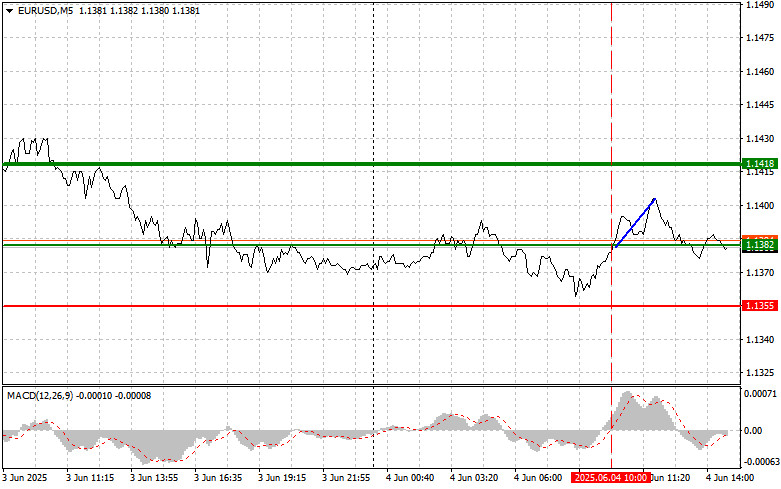

The price test at 1.1382 occurred when the MACD indicator had just started to move up from the zero mark, confirming a proper entry point for buying the euro and resulting in a 15-point rise. May business activity data for eurozone countries, excluding Germany, showed improvement, boosting EUR/USD growth momentum, although no significant rally followed. Investors remain cautious, awaiting more definitive signals from the European Central Bank regarding future monetary policy, which will be clarified tomorrow. Technical analysis also confirms the dominance of the upward trend. However, breaking through key support levels could trigger a weakening of the euro against the dollar.

Such a development could occur only if strong ADP employment data and U.S. services PMI and composite PMI indexes are released. These macroeconomic indicators are crucial barometers of the health of the U.S. economy and can heavily influence forecasts for future Federal Reserve policy. A convincing increase in employment according to ADP data would reinforce confidence in labor market stability and likely support keeping interest rates high to fully suppress inflation. Meanwhile, high services PMI and composite index readings would indicate growing business activity, helping the dollar strengthen.

Conversely, if the data falls short of expectations, concerns about slowing economic growth could arise, prompting the Fed to act more cautiously. Such a scenario could weaken the dollar and strengthen the euro.

For intraday strategy, I will mainly rely on the execution of scenarios #1 and #2.

Buy Signal

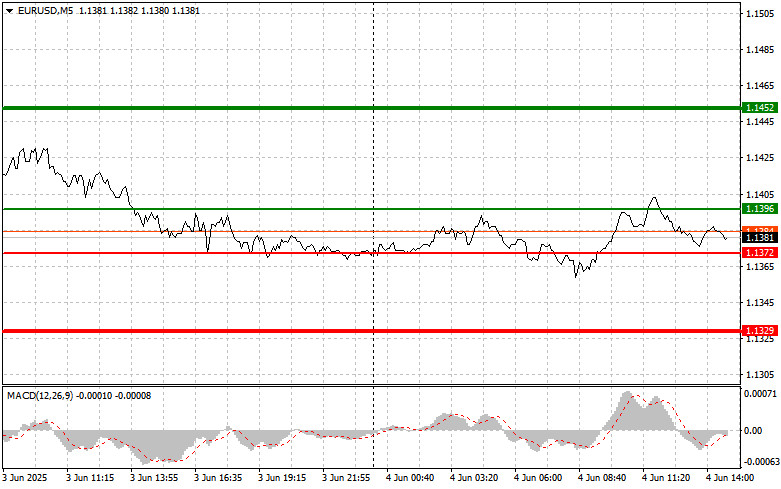

Scenario #1:Today, I plan to buy the euro upon reaching the 1.1396 area (green line on the chart), targeting a rise to 1.1452. At 1.1452, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. Expecting euro growth today is only reasonable after weak U.S. statistics.Important! Before buying, make sure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2:I also plan to buy the euro today in case of two consecutive tests of the 1.1372 level when the MACD is in oversold territory. This will limit the pair's downward potential and lead to a market reversal upward. Growth can be expected toward the opposite levels of 1.1396 and 1.1452.

Sell Signal

Scenario #1:I plan to sell the euro after reaching the 1.1372 level (red line on the chart). The target will be 1.1329, where I will exit the market and immediately buy in the opposite direction (expecting a 20–25 point move back from the level). Pressure on the pair may return today after strong U.S. data.Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2:I also plan to sell the euro today in case of two consecutive tests of the 1.1396 level when the MACD is in overbought territory. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.1372 and 1.1329 can be expected.

What's on the Chart:

- Thin green line – entry price where you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or manually lock in profits, as further growth above this level is unlikely;

- Thin red line – entry price where you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or manually lock in profits, as further decline below this level is unlikely;

- MACD Indicator – When entering the market, it is important to follow overbought and oversold areas.

Important:Beginner Forex traders must be very cautious when deciding to enter the market. It is best to stay out of the market before the release of major fundamental reports to avoid sudden price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not practice proper money management and trade with large volumes.

And remember, successful trading requires a clear trading plan, like the one I presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.