Trade Review and Tips for Trading the Euro

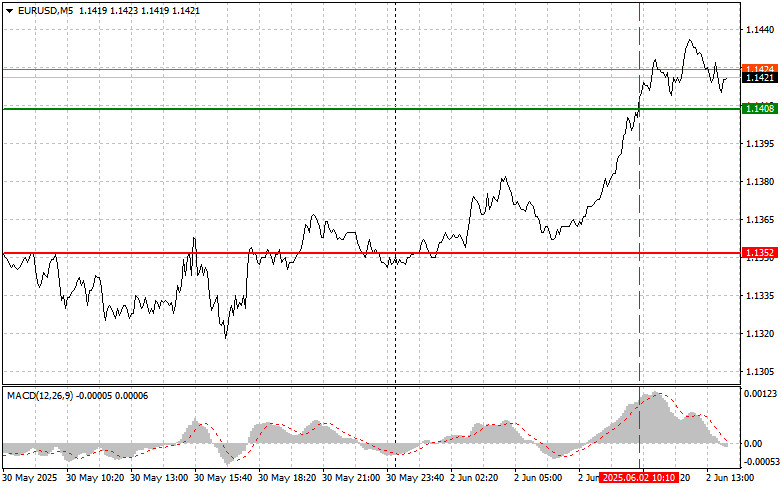

The price test at 1.1408 occurred when the MACD indicator had already moved significantly above the zero line, limiting the pair's upward potential. For this reason, I did not buy the euro.

Mixed data from the manufacturing sector in Eurozone countries did not prevent the euro from strengthening in the first half of the day. Investors apparently place more importance on the likelihood of key interest rate cuts by the European Central Bank (ECB) than on current economic indicators. Today's reports showed that the manufacturing sector in Germany—the Eurozone's largest economy—contracted in July, as did the manufacturing sectors in several other European countries. This points to ongoing challenges in the sector and the need for further economic stimulus. Despite this, the euro continued its upward momentum as market participants predict that the ECB will continue cutting rates, aiding the return to a positive growth trajectory.

During the U.S. trading session, similar ISM Manufacturing Index figures for the U.S. will be released. In addition, Federal Reserve Chair Jerome Powell and FOMC member Lorie K. Logan are scheduled to speak. These events will attract significant attention, as Fed officials' remarks could shed light on the future course of monetary policy. In a context of stabilizing inflation, Powell's remarks will carry considerable weight in the forex market. Whether Powell can convince investors of the Fed's firm commitment to fighting inflation remains an open question. If his rhetoric is not convincing enough, it could trigger another wave of U.S. dollar sell-offs.

At the same time, the ISM data will act as an important barometer, reflecting the current state of the U.S. manufacturing sector. Better-than-expected results could strengthen confidence in the resilience of the U.S. economy and support the dollar.

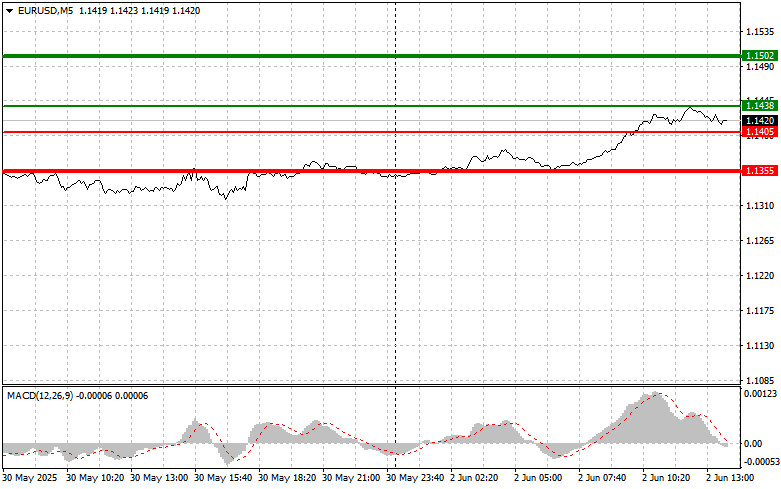

As for the intraday strategy, I will rely mainly on the implementation of Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Buy the euro today upon reaching the 1.1438 level (green line on the chart) with a target of rising to 1.1502. I plan to exit the market at 1.1502 and sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A rise in the euro today is only likely after weak U.S. statistics. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1405 price, at a moment when the MACD is in the oversold area. This will limit the pair's downward potential and could trigger an upward reversal. Expect growth toward the 1.1438 and 1.1502 levels.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1405 (red line on the chart). The target will be 1.1355, where I plan to exit and immediately buy back in the opposite direction (expecting a 20–25 point rebound). Selling pressure could return after the data release. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of 1.1438 when the MACD is in the overbought area. This would limit the pair's upward potential and could cause a reversal downward. Expect a decline toward 1.1405 and 1.1355.

Chart Key:

- Thin green line: Entry price to buy the trading instrument.

- Thick green line: Target price for setting Take Profit or manually closing the position, as further growth beyond this level is unlikely.

- Thin red line: Entry price to sell the trading instrument.

- Thick red line: Target price for setting Take Profit or manually closing the position, as further declines beyond this level are unlikely.

- MACD Indicator: When entering the market, it's important to focus on overbought and oversold zones.

Important: Beginner traders in the Forex market must be extremely cautious when deciding to enter the market. It is best to stay out of the market before major fundamental reports to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes. And remember, successful trading requires having a clear trading plan, similar to the one presented above. Making spontaneous trading decisions based on current market conditions is initially a losing strategy for intraday traders.