The EUR/USD currency pair continued its slight downward movement on Thursday morning but surged sharply upward in the afternoon. We observed a strong emotional reaction from traders linked to the ruling of the U.S. Court of International Trade. The Court ruled that all tariffs imposed by Trump were unlawful. Despite this decision, the dollar even gained a little more. However, we would say this was merely a check, not a checkmate, for the American president. Let's break down why.

Trump's decision to impose tariffs against 75 countries became possible due to his declaration of a state of emergency in trade. He found an appropriate law that allowed declaring an emergency on dubious grounds. The situation is absurd: a state of emergency was declared not because of a natural disaster, war, or internal unrest but due to a trade deficit, which had been a routine occurrence for decades. Moreover, most experts believe that America's current prosperity and wealth are largely owed to free trade. However, in true Trumpian fashion, he imposed new global trade rules.

From the outset, many questioned whether the U.S. president had the right to make such major economic decisions without Congressional approval. Does this imply that Congress is unnecessary for important decisions—simply declare an emergency and rule unilaterally? In our opinion, this highlights a serious loophole in U.S. law, and it seems Trump's team had been preparing for this scenario for months. However, the Court ruled that Trump had no authority to impose tariffs at his own discretion, even in a state of emergency.

At the moment, the tariffs have been overturned, but only on paper. Trump's team has already filed an appeal to the Supreme Court. And now the bureaucracy begins. The political affiliation of Supreme Court justices becomes crucial—Republican judges are likely to side with Trump. This is another glaring loophole in the U.S. system: as we all know, any law can be bent and interpreted in favor of certain individuals.

Thus, while Trump has certainly been put in check, checkmate is unlikely. The Supreme Court will deliberate and could very well uphold the tariffs. This explains the modest reaction of the U.S. dollar to what should have been a significant event. If the tariffs were truly gone, the dollar should have returned to its pre-collapse levels—somewhere around 1.03–1.04 EUR/USD. However, the market still doesn't believe in any Trump-related positivity. The market doesn't trust Trump, and now, it seems, not even the U.S. judiciary. If the Supreme Court overturns the lower court's ruling, it will prove that the law is equal for all—but some people are simply above the law.

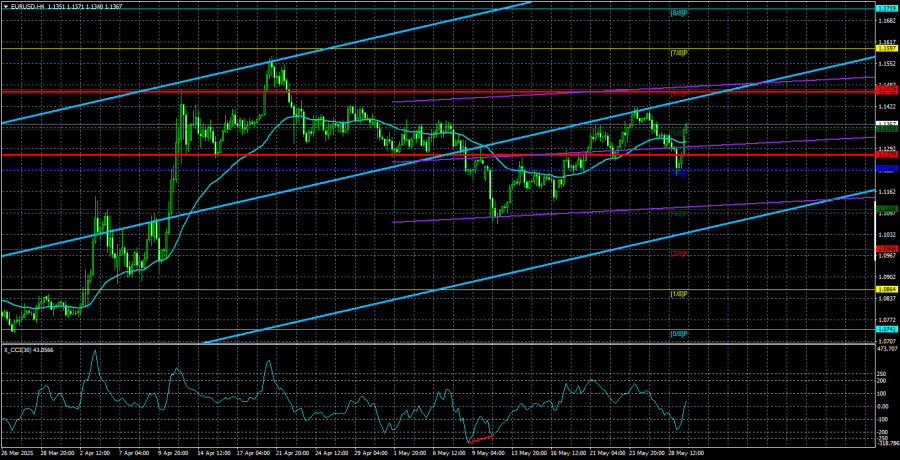

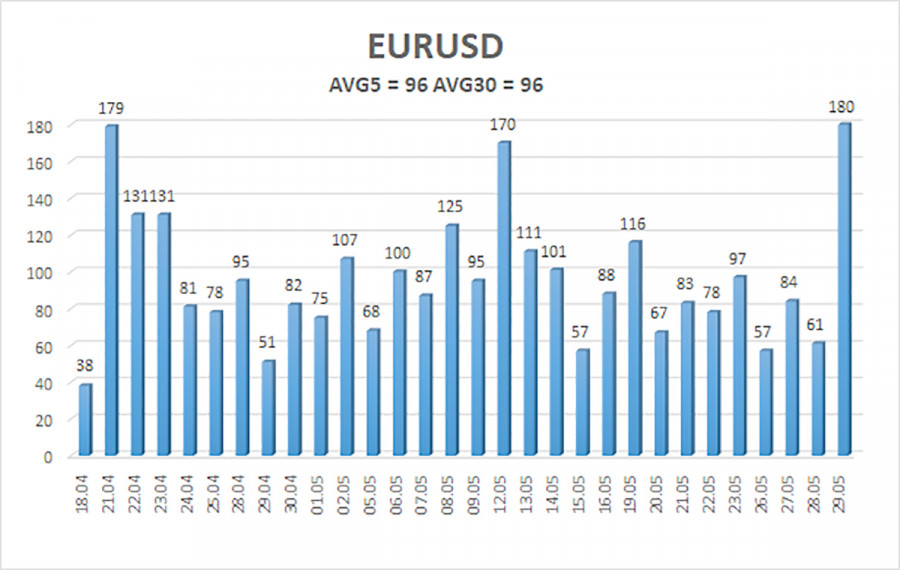

The average volatility of the EUR/USD pair over the past five trading days stands at 96 pips, classified as "moderate." We expect the pair to move between 1.1274 and 1.1466 on Friday. The long-term regression channel remains upward-sloping, indicating a continuing uptrend. The CCI indicator has entered the oversold zone, and a bullish divergence has formed, suggesting that the uptrend is likely to resume.

Nearest Support Levels:

S1 – 1.1353

S2 – 1.1230

S3 – 1.1108

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1597

R3 – 1.1719

Trading Recommendations:

The EUR/USD pair is trying to resume its upward trend. For months, we have maintained that only a decline was expected for the euro in the midterm because the dollar had no good reasons to fall apart—except for Trump's policies, which are likely to have devastating effects on the U.S. economy. However, the market remains completely unwilling to buy dollars, even when there are valid reasons to do so, and entirely disregards positive factors for the greenback.

When the price is below the moving average, shorts with targets of 1.1230 and 1.1108 are appropriate but don't expect a strong dollar rally. If the price is above the moving average, longs targeting 1.1475 and 1.1597 should be considered.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.